“Did you know that a customer referred by a friend is four times more likely to make a purchase compared to a new customer acquired through other means?” This compelling statistic highlights the immense power of referral marketing, especially in the fintech industry. Imagine leveraging the trust and influence of your satisfied customers to organically grow your user base—this is the magic of referral marketing.

In today’s competitive fintech landscape, referral programs have emerged as a potent strategy for customer acquisition and retention. This blog aims to educate you about the top 12 fintech referral programs, showcasing how these companies successfully use referral marketing to fuel their growth. By understanding the mechanics and benefits of these programs, you can implement similar strategies to enhance your own marketing efforts.

Fintech referral programs offer numerous benefits. They increase customer trust and credibility, provide cost-effective customer acquisition, and enhance customer loyalty and retention. Whether you’re a business owner, marketer, or simply interested in improving your marketing tactics, these insights will guide you in leveraging referral marketing to achieve substantial growth.

Dive in to discover how fintech companies leverage the power of referral programs to drive exponential growth and learn how you can replicate their success.

II. Understanding Fintech Referral Programs

So, what exactly is a fintech referral program, and why is it so crucial?

A fintech referral program is a marketing strategy where existing customers are incentivized to refer new users to a fintech service. This approach leverages the power of word-of-mouth marketing, turning satisfied customers into brand advocates.

But why is it essential?

Firstly, referral marketing significantly increases customer trust and credibility. People trust recommendations from friends and family more than traditional advertising. When a friend endorses a fintech service, it carries more weight, leading to higher conversion rates.

Secondly, fintech referral programs are cost-effective. Instead of spending large sums on traditional advertising channels, companies can rely on their existing customer base to spread the word. This not only reduces marketing costs but also ensures a higher return on investment.

Moreover, referral programs enhance customer loyalty and retention. When customers participate in a referral program, they feel more connected to the brand. The rewards they receive create a positive feedback loop, encouraging them to stay engaged and continue using the service.

In short, fintech referral programs offer a trifecta of benefits: they build customer trust, provide cost-effective marketing solutions, and enhance customer loyalty. By understanding and implementing these programs, fintech companies can achieve sustainable growth and a loyal customer base.

III. Best Fintech Referral Programs: Top 12 Examples

Here, we dive into the top 12 fintech referral programs that have set benchmarks in the industry. Each program is analyzed for its unique approach, incentives, and success factors, providing a comprehensive guide for businesses looking to replicate their success.

1. PensionBee

PensionBee is an online pension provider that simplifies pension management by consolidating users’ old pensions into a single, easy-to-manage online plan. Their service is designed to provide transparency, flexibility, and low fees, making it easier for users to keep track of their retirement savings.

The PensionBee referral program offers a straightforward and attractive incentive: both the referrer and the referee receive a £100 reward when the referred friend completes a task of opening an account and adding £100 or more . This dual-sided reward system not only encourages existing customers to refer friends but also entices new users to join and complete the necessary steps.

What makes PensionBee’s referral program successful is the simplicity and appeal of the cash incentive. Trust-based recommendations play a crucial role in the financial sector, and the cash reward provides a tangible benefit for both parties involved. This approach has helped PensionBee increase its user base and enhance customer engagement effectively.

By leveraging these trust-based recommendations and straightforward incentives, PensionBee has positioned its referral program as a key driver for growth and customer acquisition.

2. Stax Payment

Stax, formerly known as Fattmerchant, is a fintech company that offers subscription-based payment processing solutions for businesses. Their innovative approach includes flat-rate pricing and comprehensive data analytics, making payment processing more transparent and affordable for businesses of all sizes.

The Stax Payment referral program stands out with its substantial financial incentive: up to $500 for each referred customer. This high reward motivates existing customers to leverage their business networks and refer other businesses to Stax.

The success of Stax’s referral program lies in the significant monetary reward and the strong business network leverage. By offering a compelling financial incentive, Stax effectively encourages word-of-mouth marketing among businesses, driving substantial growth and customer acquisition.

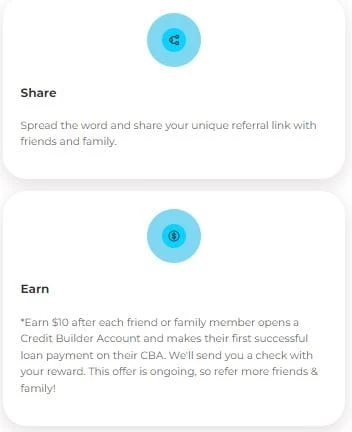

3. Self

Self is a fintech company dedicated to helping individuals build credit through credit-building loans and secured credit cards. Their services are designed to assist users in improving their credit scores, which can open doors to better financial opportunities.

The Self referral program offers a straightforward $10 reward for both the referrer and the referee when the referred friend opens a Credit Builder Account. This mutual benefit makes it easy for customers to share their positive experiences and bring in new users.

What sets Self’s referral program apart is its simplicity and mutual benefit. The uncomplicated process and the tangible reward for both parties make it attractive and easy to participate in. This strategy has successfully driven user growth and engagement, helping more people improve their financial health through credit building.

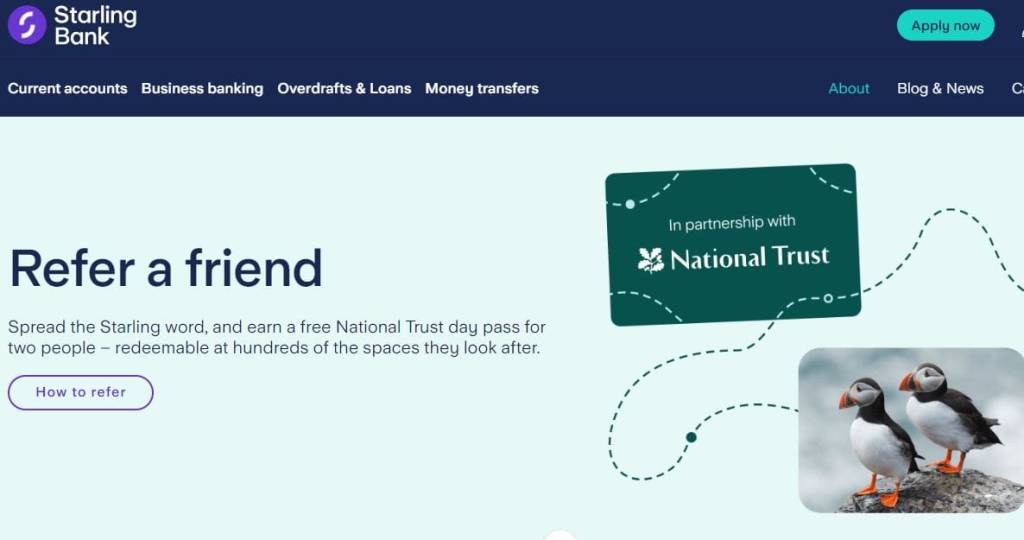

4. Starling Bank

Starling Bank is a UK-based digital bank offering a variety of financial services including personal, business, and joint accounts. Known for its user-friendly app, Starling provides features like real-time payment notifications, budgeting tools, and fee-free international spending, which have made it a popular choice among digital-savvy customers.

The Starling Bank referral program is straightforward and appealing: both the referrer and the referee receive a free “ National Trust day pass” when the new customer opens an account and completes a transaction. This simple yet effective incentive encourages customers to recommend Starling Bank to their friends and family, capitalizing on trust-based recommendations.

The success of Starling Bank’s referral program can be attributed to its ease of participation and the trust factor inherent in personal recommendations. By offering a clear financial incentive, Starling Bank ensures that both the referrer and the referee feel valued and rewarded, fostering a sense of community and engagement among its users. This approach has significantly boosted customer acquisition and loyalty, positioning Starling Bank as a leader in digital banking innovation.

5. TransferGo

TransferGo is a fintech company that provides a low-cost international money transfer service, ensuring fast and secure transfers for both individuals and businesses. Known for its competitive rates and user-friendly platform, TransferGo has become a preferred choice for those needing to send money abroad efficiently.

The TransferGo referral program offers a £20 reward for every person to TransferGo and when the referred person signs up and starts transferring, the referrer will get £20 every time . This straightforward incentive encourages users to recommend the service to friends and family, making it easy to participate and benefit from the program.

What makes TransferGo’s referral program stand out is its clear and attractive financial incentive. The program is designed to be simple and hassle-free, allowing users to quickly share their positive experiences and invite others to join. This approach has significantly boosted TransferGo’s customer base and engagement, leveraging trust-based recommendations to drive growth.

6. PayPal

PayPal is a global online payment system that allows users to make payments, transfer money, and accept payments securely. As one of the pioneers in digital payments, PayPal has established itself as a trusted and reliable platform for both personal and business transactions.

The PayPal referral program is designed to be simple and attractive: both the referrer and the referee receive a $10 reward after the referee signs up and completes a $5 transaction. This dual-sided incentive is easy to understand and participate in, making it appealing to a wide audience.

What makes PayPal’s referral program successful is its simplicity and the tangible cash incentive. By offering a straightforward and immediate reward, PayPal encourages users to spread the word about their services. This approach not only drives new user sign-ups but also fosters trust and engagement among existing users, reinforcing PayPal’s position as a leader in the online payment industry.

7. SoFi

SoFi is a financial services company that offers a wide range of products, including student loan refinancing, personal loans, mortgages, and investment management. Their goal is to provide modern financial solutions to help members achieve their financial goals.

The SoFi referral program is notable for its tailored rewards based on the specific product being referred. For instance, users can earn up to $50 for referring a friend who opens a SoFi Money account and deposits $500. This varied reward structure makes it attractive for users to refer friends across multiple products.

What sets SoFi’s referral program apart is its comprehensive coverage and tailored incentives. By offering different rewards for various products, SoFi ensures that users are motivated to refer friends regardless of their financial needs. This approach has been highly effective in driving customer acquisition and engagement, helping SoFi expand its user base and enhance customer loyalty.

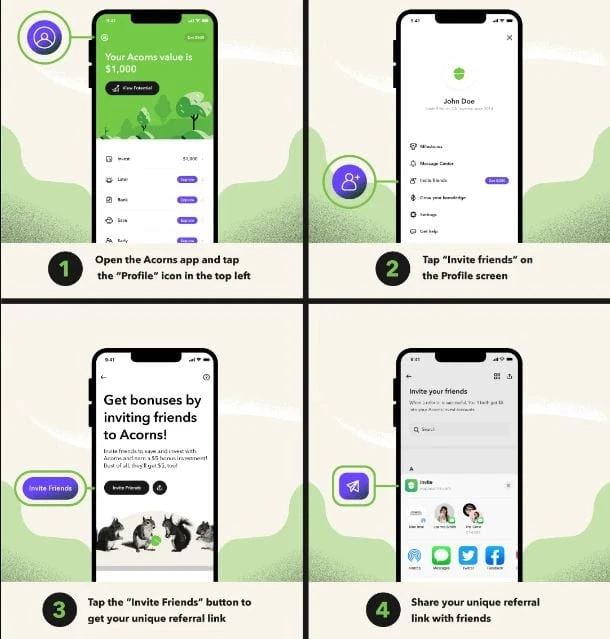

8. Acorns

Acorns is a micro-investing app that helps users invest their spare change from everyday purchases into diversified portfolios. By rounding up transactions to the nearest dollar and investing the difference, Acorns makes investing accessible and straightforward for everyone.

The Acorns referral program is simple and enticing: both the referrer and the referee receive $5 when the referee opens an account and starts investing. This mutual benefit makes it easy for users to share their positive experiences and invite others to join the platform.

What makes Acorns’ referral program successful is its ease of participation and the mutual benefit it provides. The uncomplicated process and tangible reward for both parties make it attractive and straightforward. This approach has significantly boosted Acorns’ user growth and engagement, helping more people take their first steps toward financial growth through micro-investing.

9. Revolut

Revolut is a digital banking app that offers a wide range of financial services, including currency exchange, stock trading, and cryptocurrency transactions. With its user-friendly interface and innovative features, Revolut has quickly become a favorite among tech-savvy individuals looking for a comprehensive financial solution.

The Revolut referral program is designed to be both enticing and straightforward. Users receive cash rewards of $5 for each friend they refer who orders a physical card and completes it within 60 days. This significant reward motivates users to spread the word about Revolut’s versatile services.

What makes Revolut’s referral program particularly successful is the combination of attractive cash incentives and a straightforward referral process. By simplifying the steps required to earn the reward, Revolut ensures that users can easily participate and benefit from the program. This strategy has effectively driven customer growth and engagement, positioning Revolut as a leader in the digital banking space.

10. Wise (formerly TransferWise)

Wise, formerly known as TransferWise, is an international money transfer service that offers low-cost, transparent, and fast transfers. By providing an alternative to traditional banks, Wise has made it easier and cheaper for people and businesses to send money across borders.

The Wise referral program offers a simple yet attractive incentive: users can earn a free transfer or a cash bonus upto £75 for every 3 friends they refer who completes a qualifying transfer. This transparent reward system makes it easy for users to understand and participate in the program.

The success of Wise’s referral program lies in its simplicity and transparency. By clearly communicating the rewards and ensuring an easy referral process, Wise has built a program that encourages trust and participation. This approach has significantly increased their user base, leveraging word-of-mouth marketing to drive growth in the competitive fintech space.

11. Taxfix

Taxfix is a mobile app that revolutionises the process of filing tax returns by simplifying and streamlining the entire procedure. The app guides users through their tax returns step-by-step, making it easy even for those with little to no tax knowledge to file their taxes accurately and efficiently.

The Taxfix referral program offers attractive dual-sided incentives. When a user refers to a friend, the referrer receives a €30 Amazon voucher, while the referee enjoys a 50% discount on their first tax return service. This mutual benefit encourages users to share the app with friends and family, ensuring both parties gain valuable rewards.

The success of the Taxfix referral program can be attributed to its valuable and appealing incentives. By offering tangible rewards like Amazon vouchers and significant discounts, Taxfix motivates users to participate actively in the referral program. This approach not only increases user engagement but also helps expand the customer base through trusted, personal recommendations.

12. Velo by East West Bank

Velo by East West Bank specializes in mobile and online banking services for people living outside the United States. They offer seamless, convenient international banking solutions tailored to the needs of global customers.

Velo’s referral program is straightforward and beneficial for both parties. It rewards the referrer and the referred friend with $20 in fee credits when the new user opens and funds a qualifying account. This simple yet effective incentive encourages existing customers to spread the word about Velo’s services.

Velo leverages the power of personal networks and trust, crucial elements in the financial sector. Their approach not only attracts new users but also fosters a community of engaged customers. This smart use of referral marketing helps Velo grow organically while maintaining strong customer relationships.

IV. Conclusion

From PensionBee’s straightforward cash incentives to TransferGo’s simple yet effective financial rewards, each program demonstrates how leveraging word-of-mouth marketing can drive substantial growth and engagement.

The key takeaway?

Fintech referral programs not only boost customer acquisition but also foster trust and loyalty. Still not convinced? Learn how referral program can help boost growth for your fintech business.

To implement your own referral program, Consider using Referral Rocket to help you supercharge your marketing strategies and achieve business growth. As the saying goes, “The best marketing doesn’t feel like marketing.” Start your referral marketing journey today!